- By David Lyons, South Florida Sun Sentinel

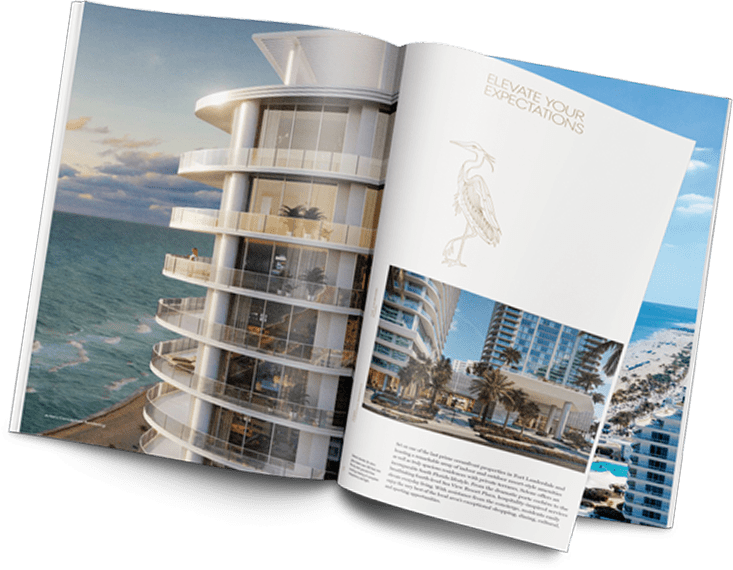

New twin condo towers rising 300 feet are coming to Fort Lauderdale beach in 2025, but already the developer has 120 prospective buyer reservations for the project’s 196 units that range in price from $900,000 to $4 million. (Kobi Karp Architecture / Courtesy)

For many high-rise condo dwellers who are looking to leave their older buildings, trading up may be hard to do.

The fancy new high rises on the drawing boards or about to open are priced above levels that many middle to upper income groups can afford.

Here’s a sprinkling of new luxury condos — which dominate the market — and their price tags:

- In Fort Lauderdale, units at the proposed twin-tower Selene Oceanfront Residences, along State Road A1A, which is slated for a 2025 opening, start at $900,000 and top out at around $4 million.

- In Pompano Beach, the Related Group recently obtained a construction loan to complete Solemar, an oceanfront condo tower with 105 residences that broke ground in May. It’s now 95% pre-sold, the company says, at prices starting at $1.3 million. “The price point is the best value one can find for a luxury oceanfront property of this caliber” when compared with Fort Lauderdale and Miami Beach, a company spokeswoman said.

- In Delray Beach, local politicians recently hailed the impending opening of Ocean Delray, a three-story building with 19 units ranging from $5.7 million to $10 million. Another nearby project called 1625 Ocean is expected to start construction with 14 units going for $3.9 million to $7.5 million. Elected officials are happy because of an expected surge in tax revenues the upscale projects will deliver to city coffers.

The luxury condo project Ocean Delray is seen under construction, early last month on the beach in Delray Beach. (Joe Cavaretta/South Florida Sun Sentinel)

Meanwhile, prices and sales of existing condos continue to move northward year over year, according to recent figures released by Broward, Palm Beach Beaches and St. Lucie Realtors group.

In Broward, median sales prices for condos and townhomes were up 10.1% to $220,000 in August versus $199,900 in the same month last year. The number of sales rose by 26.8% to 1,797 from 1,417. In Palm Beach County, median August prices rose 7.9% to $232,000 from $215,000, The number of sales rose 24.7% to 1,448 from 1,210.

Better profit potential

Developers say they have good reason to focus on the high-end, luxury market and not projects that would appeal to lower-level wage earners. It’s hard to make money these days by concentrating on projects with lower prices.

Besides the havoc wrought on the economy by the COVID-19 pandemic, high prices for materials, land and labor have dogged the real estate development industry for several years, analysts and executives say.

“It’s a very challenging time, which means developers are going to benefit and achieve [price] premiums,” said analyst Peter Zalewski, founder of Condo Vultures in Miami.

“It’s almost like a perfect storm form a cost perspective,” said Ed Jahn, a senior vice president at Kolter Group of Delray Beach, which develops mixed use projects in downtowns across Florida. “We would love to do more projects that are less than $1 million — in the $800,000 range. It’s very hard to do those projects and have them fit into the business equation.”

He said there is considerable demand for upscale units ranging in price from $900,000 to $2.5 million or $3 million. “Those buyers want to be in the Class A locations” such as beach areas and burgeoning downtowns.

The Selene project, which opened a sales office just two weeks ago, has yet to start construction. Yet, the company has already received 120 reservations for the project’s 196 units that will take three years to build.

“It’s been very positively received” by would-be residents locally and from out of state, including one from California, Jahn said.

“There are so many more people coming from California, more so than I’ve ever seen in my previous 20 years in the Florida market,” he added.

In downtown Fort Lauderdale, site of Kolter’s 100 Las Olas project, which opened in the spring of 2020, buyers have snapped up all but four units in the 46-story building, which also includes a Hyatt Centric Hotel.

Eddie V’s restaurant in the 100 Las Olas tower in downtown Fort Lauderdale. The 46-story condo tower, which opened the spring of 2020 and also houses a Hyatt Centric Hotel, has only four units left to sell, the developer says, (Amy Beth Bennett / South Florida Sun Sentinel)

Commercial real estate developers note that South Florida is an “outlier” market that was well-positioned during the pandemic to draw large numbers of upper income, relocation-minded migrants from other parts of the country.

Their high personal incomes were tailormade for a market like South Florida, where luxury condo prices may be regarded as high by local residents, but not so much by New Yorkers accustomed to paying more.

“We had a good story to tell when the pandemic hit and urban cores of other cities in the Northeast and California emptied out,” said Stephen Bittel, CEO and founder of Terranova Corp., a commercial real estate firm based in Miami Beach that owns and operates retail properties in the Boca Raton area.

Favorable weather and tax rates and a pro-business environment all “triggered a relocation movement from around the country into South Florida,” Bittel said, attracting top executives who head companies from the financial and technology industries.

More people from the lower echelons of those companies will follow, he predicted.

A hunt for land

If they’re in the market for condos, The Related Group, the long-time Miami-based condo builder, is moving to create more units to sell up and down the Gold Coast,

Nicholas Perez, a Related vice president and a son of founder Jorge Perez, said Friday the company is looking for more land on which to build.

He said Related, which is trying to build a luxury high-rise on public beach land in a deal with the city of Hollywood, owns property on North Flagler Drive in West Palm Beach and is seeking opportunities as far north as Jupiter.

The company’s Hollywood project has drawn criticism from people who don’t want a last vestige of public beach to be converted into another high-rise development.

Perez insists the project, which would deliver millions of dollars to the city if built, would deliver considerable benefits to city residents.

“I do believe and feel strongly that what we are proposing for the City of Hollywood really would be a benefit to everyone,” Perez said.

An illustration shows a 30-story condo tower planned on public land at 1301 South Ocean Drive on Hollywood Beach in a proposed deal between The Related Group and the city. Developers are aggressively seeking on which to build new condos amid a tight South Florida market. (The Related Group/Courtesy)

Besides buildings from scratch, the company is interested in taking over older buildings to demolish them and build new structures.

In addition, Perez said the company has thought about converting the 455-foot Icon Las Olas rental tower it owns in downtown Fort Lauderdale to condos. When it opened in 2017, the elder Perez decided the time wasn’t right for the high-rise to be a condo tower.

Now, that time could be near, Nicholas Perez suggested. “That is definitely in back of our mind as a great opportunity,” he said.

And he acknowledged that Related is in a deal with another company to take over the 65-year-old Carlton Terrace, a 15-story tower in Bal Harbour, to redevelop the property.

“I think the future of beachfront development is looking at these older buildings for capital improvements and developing something where you get more density,” he said.

After the Surfside condo tower disaster that killed 98 people, Perez said many people in older buildings are looking for more modern places to live.

“There has definitely been a flight to new, especially in the wake of the Surfside tragedy,” he said.