By David Lyons, South Florida Sun Sentinel

South Florida luxury homes and condos are selling so fast that eager buyers are snapping up those that are yet to be built.

From $1 million plus homes to a $15 million penthouse overlooking Fort Lauderdale beach, high end residences flew off the charts in the first quarter of this year, raising questions of how much longer the supplies will last.

Refugees from the usual Northeast cities aren’t the only buyers, brokers and analysts say. The tri-county region has become so attractive that it is drawing moneyed migrants from California, Chicago, Texas, and even Wyoming.

The pace and volume of home and condo sales for the first quarter of 2021 have stunned veteran brokers. The Keyes Co., a major Florida broker for decades, this week reported exponential increases in first quarter sales for the tri-county area compared with last year.

High-end single-family sales rose from 826 in the first quarter of 2020 to 1,786 this year, with the average sales prices increasing by 20.1%, from $2.55 million to $3.06 million. Cash sales more than doubled from 460 to 1,043. The brokerage’s condo sales also more than doubled from 425 to 984, with the average sales prices rising from $2.23 million to $2.41 million. Cash sales rose from 303 to 725.

“It has been the perfect storm for South Florida’s luxury market since late last year,” said Mike Pappas, the president and CEO at Keyes. “All the converging trends, including domestic migration from high-tax states, a brutal winter around the nation and historically low interest rates, are resulting in an unprecedented high-end market.”

J.J. Bunnett, a company CEO from Jackson Hole, Wyoming, is buying a waterfront condo at 160 Marina Bay in Las Olas Isles, a 16-unit project now under construction and scheduled for occupancy next year. He sees South Florida as an ideal retreat because he likes how Gov. Ron DeSantis managed the economy during the COVID-19 pandemic.

“The pandemic policies have been ones that lean more on individual freedom and risk assessment,” he said. “I think the governor has done an excellent job balancing all of that. And the tax code is attractive.”

“Getting in on the first end of it, we figured it would go up in value compared to buying something else in another building in Fort Lauderdale that was either new or already existing,” she said. “We figured while it was being built we would also build some equity.

Jennifer Pryor and her husband, a company CEO in Atlanta, said she and her spouse expect to close Tuesday on a single-family home in North Miami Beach — after spending months conducting a search that ranged from Lighthouse Point to Miami.

“We can work from anywhere,” she said. Her husband, a “huge boater,” wanted to be near an inlet. “We’re going to be popping down to the Keys and going to the Bahamas,” she said.

Under the guidance of Keyes broker Les Waites, they hit more than 20 homes — most of them under contract — before deciding on their luxury house in North Miami-Dade. They cinched a deal after a previous offer from another would-be buyer fell through.

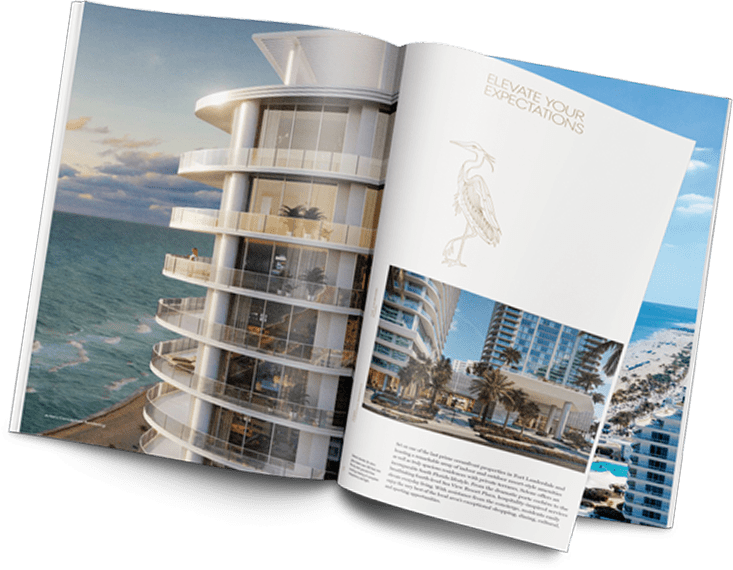

Down the road on A1A, Kolter’s 26-story, twin-tower Selene Oceanfront Residents project launched sales of 200 residences starting at $900,000. Penthouse units reach into an unspecified million-dollar-plus range. A number of people put down deposits. Among the visitors was a Boca Raton couple who think their Mizner Park area neighborhood is getting too crowded.

Analysts and brokers figure that as COVID-19 vaccines become more prevalent and would-be sellers become more comfortable with the idea of placing their homes on the market, more homes will become available for hungry buyers.

George Ratiu, senior economist at realtor.com, sees a tight supply running into 2022 as buyers use real estate as a hedge against a potential rise in inflation and builders fight to close a U.S. home shortage that has failed to keep pace with demand over the last decade.

Laura Brady, CEO of Concierge Auctions, the national firm that helped sell the Fort Lauderdale estate of the late billionaire H. Wayne Huizenga, sees no immediate slowdown of buyer interest in sight.

“Our volume has been strong and continued to increase in the last 12 months. Especially through 2020 [Florida] was one of the hottest states,” Brady said. “Unit-wise we had six sales already this year [in Florida], which is very strong.”

“We think we still have quite a ways to go in these powerful markets, especially in

Florida and Texas where there is inherit economic strength,” she added.

Mike Pappas of Keyes is closely watching the shrinking number of homes and still rising

sales on his company’s books.

In South Florida, business owners, many of them billionaires riding the wave of a strong stock market and recovering economy, are buying homes as permanent residences, not second homes.